FICO 8 vs VantageScore 3.0: Important Differences You Should Understand

Table of Contents

- By Rita

- Published: May 02, 2022

- Last Updated: May 24, 2022

Two types of credit scores exist that determine whether someone is creditworthy. FICO Score and VantageScore both use a credit range of 300 to 850. The higher the number, the greater the chances of being approved for credit.

The content below will explain vantagescore 3.0 vs fico, so you can better understand how these credit scoring models work.

What Is VantageScore 3.0?

A VantageScore is a credit score created by Experian, Equifax, and TransUnion.

VantageScore 3.0 credit score has a range from 300 to 850.

There are six categories of credit information that VantageScore uses, but they may not all impact your score.

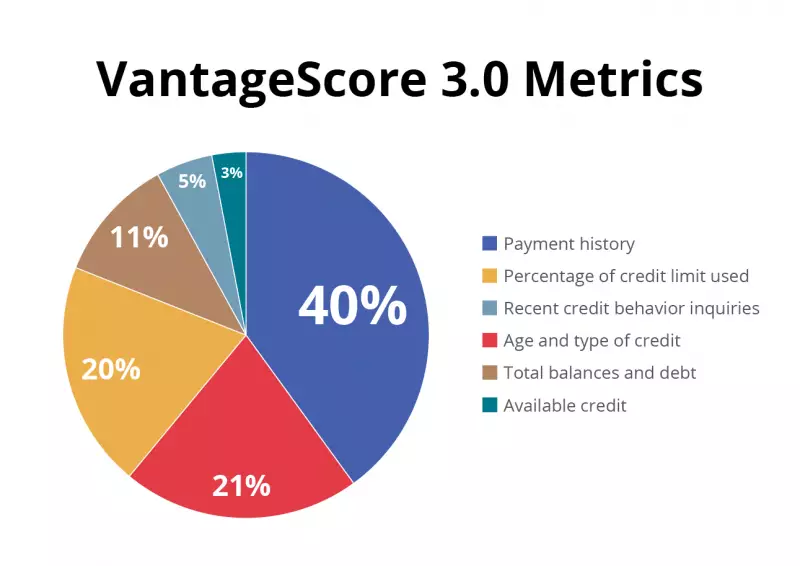

VantageScore 3.0 is calculated based on these metrics:

- Payment History - This metric is said to account for 40% of the score.

- Age and Type of Credit - This makes up 21% of the credit score calculation.

- Percentage of Credit Limit Used - It makes up 20% of your credit score calculation.

- Total Balances and Debt - It accounts for 11% of a VantageScore calculation.

- Recent Credit Behavior and Inquiries - It’s responsible for 5% of a VantageScore calculation.

- Available Credit - This factor accounts for 3% of the calculation.

What Is FICO Score 8?

Fair Isaac Corporation (FICO) created the FICO score. Lenders and other creditors use the FICO score 8 and other factors on borrowers' credit reports to determine credit risk and extend credit.

The FICO score helps financial institutions, among others, determine how risky you may be as a borrower.

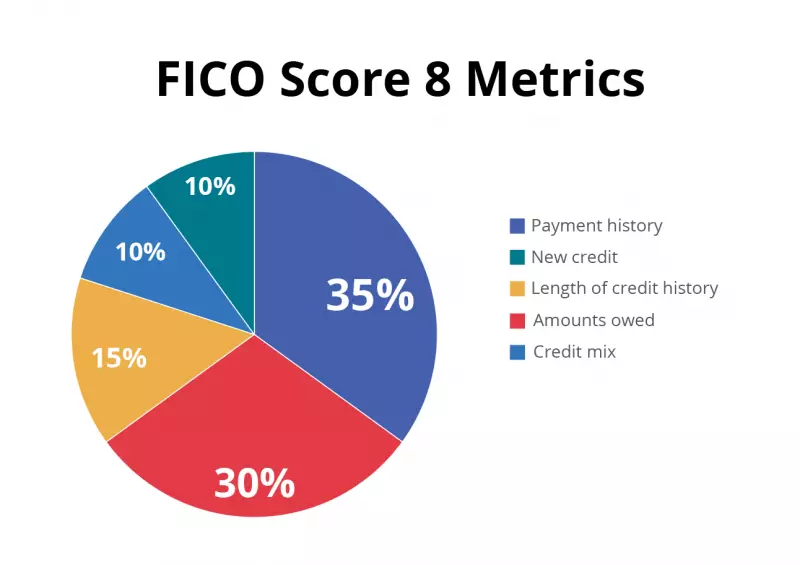

There are five categories that FICO considers when calculating scores. They are:

- Payment history - 35%

- Amounts owed - 30%

- Length of credit history - 15%

- New credit - 10%

- Credit mix - 10%

Vantagescore 3.0 vs Fico Scores: The Differences

Now that you know what FICO Scores and VantageScores are, this section will analyze vantage 3.0 vs fico 8. Some of the differences are:

-

Scoring criteria

One of your accounts must have been active for at least six months before a FICO score can be generated. Account activity is also a requirement for FICO score generation.

But the VantageScore doesn’t care how old your accounts are or how often you use them. No minimum credit history is required for VantageScore generation.

-

Trending data

Credit scores represent a snapshot of your credit profile at a certain point in time. For example, FICO uses data about your borrowing and credit utilization reported to the credit bureaus when generating the scores.

On the other hand, VantageScore uses data that reflects behavior patterns over time. It may reflect up to two years' worth of consumer spending and credit utilization data in its calculation.

-

Treatment of inquiries

When a financial institution makes a request for credit report information it is referred to as a credit inquiry. Two types of credit inquiries exist: hard inquiries and soft inquiries.

When an entity views your credit file after you apply for credit, it is called a hard inquiry. These types of inquiries will impact your credit scores. A soft inquiry usually happens when you request your credit report or you are pre-screened for a credit offer. These types of inquiries do not impact your score.

FICO and VantageScore may not treat hard inquiries the same way. FICO treats multiple hard inquiries within 45 days as a single inquiry. On the other hand, VantageScore treats numerous hard inquiries as a single inquiry if they happen within 14 days.

-

Weighting

FICO scores are based on precise percentage allocations for five main categories. On the other hand, VantageScore is based on influence descriptions for five major categories.

-

Company

FICO score was created in the 80s by Fair Isaac Corporation. The creators intended to help lenders determine which borrowers were most likely to default on a loan.

The “Big Three” companies Equifax, Experian and TransUnion formed a joint venture called VantageScore Solutions LLC.

The first VantageScore version, VantageScore 1.0, was launched in 2006. It was created to provide some consistency between the scores offered by the existing credit bureaus.

If you’re wondering, “why is my FICO score higher than Vantage?” VantageScore runs about 50 points lower than FICO, despite using the same range.

How to Get Your FICO and Vantage Scores

Getting your credit scores is relatively easy. You can get these scores from many different sources, including going directly to the three credit bureaus themselves.

However, you need to know that some providers will charge you a fee for access to your scores, while others offer them free. You need to know which scores you are getting.

VantageScore and FICO scores are very common but some entities may return scores that are meant solely for educational purposes and have no direct impact on your creditworthiness.

Make sure you know which scoring model your scores are based on.